National Interest Account

English

English  Indonesia

Indonesia National Interest Account

National Interest Account is an assignment given by the Government to LPEI to provide Export Financing for Transactions or Projects that are commercially difficult to implement but deemed necessary by the Government to support national export policies.

Conventional and/or Sharia

Provide export financing for exporters carrying out export activities to countries in Africa, South Asia and the Middle East, except for countries that receive special attention.

Covers all products from all economic sectors, both goods and services, as long as they meet domestic contributions.

Countries in Africa, South Asia and the Middle East, except for countries that receive special attention.

Rupiah or foreign currency available at Indonesia Eximbank.

Provide export financing in developing tourism activities that can bring in foreign tourists in the Mandalika Special Economic Zone.

Customers can be business entities, including individuals, who are:

Refers to the yield of the prevailing State Securities.

IDR Rupiah.

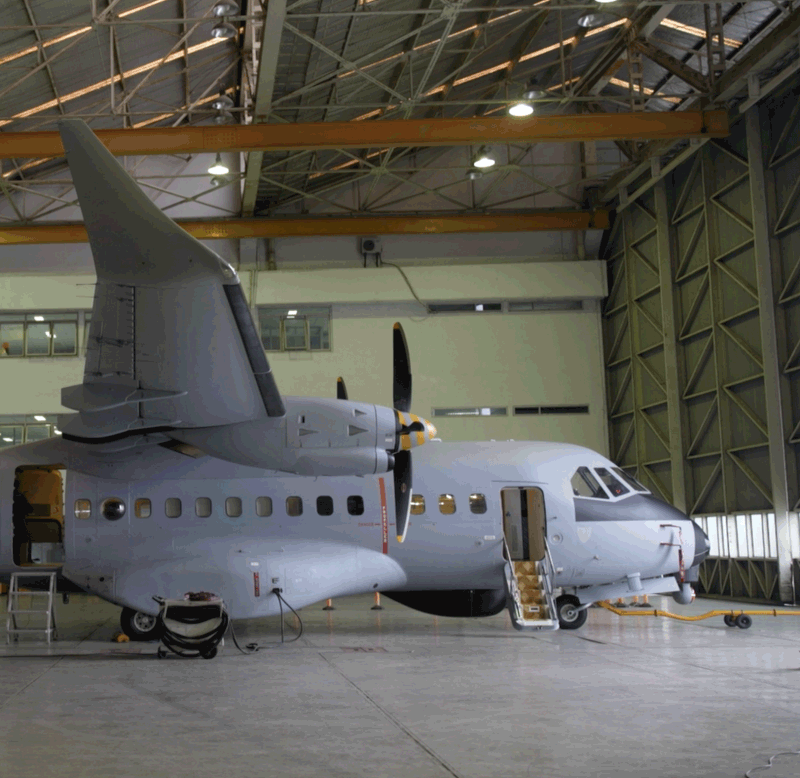

Provide export financing in order to support the Indonesian aviation industry.

Providing financing facilities to SMEs that export (both direct and indirect).

Among others:

Financing (Working capital and Investment).

Maximum 6% (including credit insurance and trade receivables insurance if any).

IDR Rupiah.

All products, both goods and services.

Providing Export Financing facilities to business actors engaged in Export activities in order to support the National Economic Recovery.

Existing customers and new customers as long as they meet the criteria of the Exporter as below:.

Agricultural sector (agriculture, forestry, and fisheries) and/or processing sector with the following export commodities:

All countries except those under special attention.

Refers to the yield of the prevailing State Securities.

Rupiah or foreign currency available at Indonesia Eximbank.

Providing Export financing in order to support the transportation equipment industry.

Rupiah or foreign currency available at Indonesia Eximbank.

Banks providing credit facilities to their borrowers engaged in export activities or activities supporting exports.

Credit Guarantee.

Rupiah or foreign currency available at Indonesia Eximbank.

Financial obligations related to working capital loans received by the Business Players, including principal loan arrears and/or interest/compensation/profit-sharing.

Provide export financing in order to support the development of marina and tourism infrastructure in super priority tourism destinations.

Customers are business entities, including individuals, who are engaged in the development and/or construction of integrated marina areas in Super Priority Tourism Destinations, namely:

Financing & Guarantees.

Rupiah

Referring to the prevailing yield of Government Securities (SBN).

For more information regarding Indonesia Eximbank Products and Services, please contact the number +62-21-39503600 (Hunting) or you can send a message via the form below :